You can also outsource the accounting function to a firm to collaborate with your bookkeeper. The most common are cash and accrual methods, which have benefits depending on their size and scale. A nonprofit must operate on an annual budget that includes all income sources and expenses. These financial responsibilities are one way to keep nonprofits on track with their finances. These positions are the backbone of your organization, but they should never be mashed into one. While a dedicated volunteer or staff member might excel at managing the books, crunching Bookkeeping for Veterinarians numbers like an accountant just isn’t their cup of tea.

- Your nonprofit’s balance sheet is also known as the statement of financial position.

- Regardless of your nonprofit size, there are several accounting software options available.

- Just because your nonprofit qualifies as tax-exempt under Section 501 doesn’t mean that all of your donors’ contributions qualify as charitable deductions.

- You’ll need to record the car as an in-kind donation from the dealership, noting even details about the model and make of the vehicle.

- In most cases, it’s better to let your accounting software or a bookkeeper take care of this step for you.

- However, some organizations, such as foreign, political, and religious organizations, are exempt from filing Form 990.

Strategies for Managing Overhead

- It’s like having an in-house team dedicated to your organization, without the overhead cost of a full accounting department.

- Not only that, the secret to successful fundraising is fully functioning back-end management powered by a solid financial integration.

- AccuFund is an excellent resource for nonprofits looking for a reliable financial management tool.

- You will also need an accountant to audit your financial statements and help work with you on future financial plans.

- Software that provides top-level financial tools isn’t helpful if your staff and board don’t understand how best to use it.

- For example, let’s say a generous donor contributes a high-yield auction item to your event.

Nonprofit bookkeepers are well-versed in the many unique compliance requirements for tax-exempt organizations, and they can manage your recordkeeping accordingly. The Internal Revenue Service (IRS) regulates nonprofit accounting with specific rules and practices for tax-exempt organizations. Following these processes diligently and accurately keeps nonprofits compliant and free from costly fines and penalties. Hiring in-house accounting staff provides nonprofits with direct control over financial What is bookkeeping operations and immediate access to financial data. This approach can be beneficial for organizations requiring real-time financial decision-making and those with complex, organization-specific accounting needs.

What is Bookkeeping for Nonprofits?

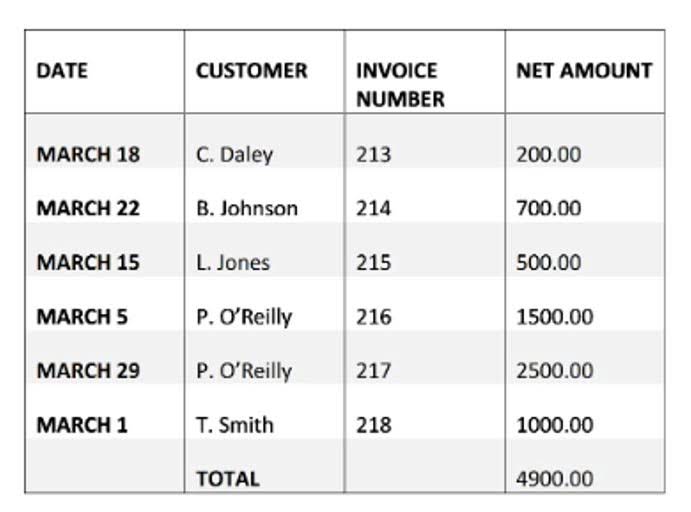

Form 990 captures information from the four financial statements above, so maintaining accuracy will help you make tax season much smoother. Penalties are in place for organizations with discrepancies in their paperwork or need to file on time, so staying on top of your tax requirements is essential. A nonprofit’s revenue usually includes program fees, membership dues, donations, sales income, proceeds from fundraising events, and investment income. Expenses for nonprofit professionals typically include travel, postage, salaries, rent, fundraising expenses, and financial services. We’ll talk about picking the right bookkeeping software, understanding financial statements, and keeping your finances healthy. This guide is for everyone, whether you’re new or experienced in nonprofit bookkeeping.

Discover the benefits of automation in financial management.

- GrowthForce accounting services provided through an alliance with SK CPA, PLLC.

- A nonprofit reconciles bank accounts by comparing the recorded amounts to the amounts on bank statements.

- FreshBooks is available on both computers and mobile devices, so you can stay on top of your nonprofit organization at any time.

- Get free guides, articles, tools and calculators to help you navigate the financial side of your business with ease.

- But while being a crusader for justice sounds pretty action-packed on paper, the reality is a bit less glamorous.

- After reading this, you might think that the role of a bookkeeper for a nonprofit setting is highly prized due to the complexity and enormity of details and responsibilities involved.

- Explore 7 expert nonprofit bookkeeping services designed to streamline your reporting, improve accuracy, and maintain nonprofit compliance.

And it doesn’t mean that all of the activities your nonprofit spends money accounting services for nonprofit organizations on aren’t taxable. Tax-exempt nonprofit employees are still subject to employment taxes, and your nonprofit could still be subject to sales, real estate and other taxes depending on which state it’s based in. Once you’ve got a bookkeeping system in place, you need to start creating financial statements. Looking at these documents can tell you how much money you have, where your money is, and how it got there.

We’ve loved helping over a thousand organizations organize and maintain their finances. Due to this love of the craft and experience in the field, we decided to put together this guide to help nonprofits like yours better understand their accounting needs. Not following these rules can harm your finances, reputation, and even shut you down. Knowing the rules from the Financial Accounting Standards Board (FASB) and the Internal Revenue Service (IRS) is vital. Keeping accurate records is vital for nonprofits to keep their tax-exempt status.

However, your final financial reports and records must be accurate and compliant. From setting your financial goals to ensuring adequate revenue, it all starts with your donors. Just like for profit accounting relies on customer data, donor management is a crucial element of your accounting strategy for this reason. The Statement of Financial Position acts as a balance sheet in nonprofit accounting.

Nonprofit vs for-profit accounting

Financial statements provide insight into how much money your nonprofit has, where you spend it, and how it’s used. You should also hire a financial officer or a treasurer who knows how to do bookkeeping for a nonprofit and is familiar with specialized accounting software. Nonprofit organizations have a tax-exempt status with the Internal Revenue Service (IRS). If they want to maintain this status, they need to do accurate bookkeeping. Get our FREE guide to nonprofit financial reports, featuring illustrations, annotations, and insights to help you better understand your organization’s finances.

Payroll

- For more information about how to create a budget, check out the National Council of Nonprofits guide to Budgeting for Nonprofits.

- The goal is to showcase that funds from restricted and nonrestricted gifts go to the right programs and projects.

- If your accounting responsibilities still roll up under your executives, consider outsourcing your accounting to the experts at a firm.

- Bookkeepers can be paid staff members or volunteers, but they should understand GAAP principles and fund accounting.

- A nonprofit’s financial statements focus on expenses and nonprofit donations to nonprofit organizations.

- As with any financial statement, ensure that all figures are accurate and up to date before submission.

Without good bookkeeping, it’s easy to lose track of donations and expenses, which can lead to mistakes and even legal trouble. Additionally, you’ll need financial statements to obtain and maintain funding, grants, and other forms of support. Accurate financial statements also ensure nonprofits manage charitable resources responsibly, ethically, and according to applicable laws. Most importantly, you should adhere to proper disclosure procedures in all financial statements as outlined in GAAP guidelines. This includes providing accurate information on all related financial transactions, such as donations and expenses. This guide will cover all the essentials of nonprofit accounting, from setting up your books to preparing financial statements.